BRIEF INTRODUCTION OF THE COURSE

What is Cryptocurrency?

A cryptocurrency is a digital or virtual currency that is secured by cryptography, which makes it nearly

impossible to counterfeit or double-spend. Many cryptocurrencies are decentralized networks based on

blockchain technology: a distributed ledger enforced by a disparate network of computers. A defining feature

of cryptocurrencies is that they are generally not issued by any central authority, rendering them

theoretically immune to government interference or manipulation.

What is Crypto Trading?

Crypto trading is simply the exchange of cryptocurrencies. This is one way of getting involved in the world

of cryptocurrencies without having to mine it. It’s a highly profitable market that you can make lots of

money from and we help you get started.

What is Crypto Mining?

cryptomining is a process in which transactions for various forms of cryptocurrency are verified and added

to the blockchain digital ledger. Each time a cryptocurrency transaction is made, a cryptocurrency miner is

responsible for ensuring the authenticity of information and updating the blockchain with the transaction.

The crypto miner is rewarded with some cryptocurrency.

Bond investments

How Bonds Work The borrowing organization promises to pay the bond back at an agreed-upon date. Until then,

the borrower makes agreed-upon interest payments to the bondholder. People who own bonds are also called

creditors or debtholders. In the old days, when people kept paper bonds, they would redeem the interest

payments by clipping coupons. Today, this is all done electronically.

Stock investments

The primary benefits of investing in the stock market is the chance to grow your money. Over time, the stock

market tends to rise in value, though the prices of individual stocks rise and fall daily. Investments in

stable companies that are able to grow tend to make profits for investors. Likewise, investing in many

different stocks will help build your wealth by leveraging growth in different sectors of the economy,

resulting in a profit even if some of your individual stocks lose value.

Annuities

An annuity is a financial product that pays out a fixed stream of payments to an individual. These financial

products are primarily used as an income stream for retirees. Annuities are created and sold by financial

institutions, which accept and invest funds from individuals. Upon annuitization, the holding institution

will issue a stream of payments at a later point in time.

Real estate

Real estate investing involves the purchase, ownership, management, rental and/or sale of real estate for

profit. Improvement of realty property as part of a real estate investment strategy is generally considered

to be a sub-specialty of real estate investing called real estate development. Real estate is an asset form

with limited liquidity relative to other investments, it is also capital intensive (although capital may be

gained through mortgage leverage) and is highly cash flow dependent. If these factors are not well

understood and managed by the investor, real estate becomes a risky investment.

IRA

An individual retirement account (IRA) is a tax-advantaged investing tool that individuals use to earmark

funds for retirement savings.So how does an IRA work? IRAs are sometimes referred to as individual

retirement arrangements, because investments held in IRAs can encompass a range of financial products,

including stocks, bonds, ETFs, and mutual funds. A self-directed IRA is a type of traditional or Roth IRA

that allows investors to make all of the investment decisions for their account and affords access to an

even broader range of investments, including real estate, private placements, and tax liens.

What is Forex?

The foreign exchange market – also known as forex or the FX market – is the world’s most traded market, with

turnover of $5.1 trillion per day.*

To put this into perspective, the U.S. stock market trades around $257 billion a day; quite a large sum, but

only a fraction of what forex trades.

Forex is traded 24 hours a day, 5 days a week across by banks, institutions and individual traders

worldwide. Unlike other financial markets, there is no centralized marketplace for forex, currencies trade

over the counter in whatever market is open at that time.

How FX Trading works

Trading forex involves the buying of one currency and simultaneous selling of another. In forex, traders

attempt to profit by buying and selling currencies by actively speculating on the direction currencies are

likely to take in the future.

World’s Major Currencies

| COUNTRY |

SYMBOL |

COUNTRY |

SYMBOL |

| United States |

USD |

Switzerland |

CHF |

| Eurozone |

EUR |

Canada |

CAD |

| Japan |

JPY |

Australia |

CAD |

| Great Britain |

GBP |

New Zealand |

NZD |

Want to know more about how to trade forex?

Our free Let’s Get to Know Forex guide will cover how to get started, help you make your first trades and

outline how to create a long-term trading plan for long-term success.

Which currencies can I trade?

Forex is the most widely traded market in the world, with more than $5.3 trillion* being bought and sold

every single day. Traders will speculate on the future direction of currencies by taking either a long or

short position, depending on whether you think the currency’s value will go up or down.

Typically referred to as “The Majors”, these seven currency pairs make up almost 80% of total daily trading

volume*. As you’ll see in the table below, the major currency pairs all include the U.S. Dollar (USD).

Major Currency Pairs

| DESCRIPTION |

SYMBOL |

NICKNAME |

| Euro/U.S. Dollar |

EUR/USD |

Euro |

| Great British Pound/US Dollar |

GBP/USD |

CABLE |

| U.S. Dollar/Japanese Yen |

USD/JPY |

YEN |

| U.S. Dollar/Swiss Franc |

USD/CHF |

SWISSY |

| U.S. Dollar/Canadian Dollar |

USD/CAD |

LOONIE |

| Australian Dollar/U.S. Dollar |

AUD/USD |

AUSSIE |

| New Zealand Dollar/U.S. Dollar |

NZD/USD |

KIWI |

Minor Currency Pairs

While the major currency pairs make up the majority of the market, you shouldn’t ignore the minors – also

referred to as Cross Currency Pairs. The minor currency pairs account for all the other combination of major

markets such as; EUR/GBP, EUR/CHF and GBP/JPY.

With so many options available, you’re probably asking yourself – which currencies should I trade? A good

rule of thumb for traders new to the market is to focus on one or two currency pairs.

Generally, traders will choose to trade the EUR/USD or USD/JPY because there is so much information and

resources available about the underlying economies. Not surprisingly, these two pairs make up much of global

daily volume.

Risk Management

- Determine Your Risk Tolerance

This is a personal choice for anyone who plans on trading any market. Most trading instructors will

throw out numbers like 1%, 2% or on up to 5% of the total value of your account risked on each trade

placed, but a lot of your comfort with these numbers is largely based on your experience level.

Newer traders are inherently less sure of themselves due to their lack of knowledge and familiarity

with trading overall or with a new system, so it makes sense to utilize the smaller percentage risk

levels.

Once you become more comfortable with the system you are using, you may feel the urge to increase

your percentage, but be cautious not to go too high. Sometimes trading methodologies can produce a

string of losses, but the goal of trading is to either realize a return or maintain enough to make

the next trade.

For instance, if you have a trading method that places one trade per day on average and you are

risking 10% of your beginning monthly balance on each trade, it would only theoretically take 10

straight losing trades to completely drain your account. So even if you are an experienced trader,

it doesn’t make much sense to risk so much on one single trade.

On the other hand, if you were to risk 2% on each trade that you place, you would theoretically have

to lose 50 consecutive trades to drain your account. Which do you think is more likely: losing 10

straight trades, or losing 50?

| STARTING BALANCE |

% RISKED ON EACH TRADE |

$ RISKED ON EACH TRADE |

# OF CONSECUTIVE LOSSES BEFORE $0 |

| $10,000 |

10% |

$1000 |

10 |

| $10,000 |

5% |

$500 |

20 |

| $10,000 |

3% |

$300 |

33 |

| $10,000 |

2% |

$200 |

50 |

| $10,000 |

1% |

$100 |

100 |

- Customize Your Contracts

The amounts of methodologies to use in trading are virtually endless. Some methods have you use a

very specific stop loss and profit target on each trade you place while others vary greatly on the

subject. For instance, if you use a strategy that calls for a 20-pip stop loss on each trade and you

only trade the EUR/USD, it would be easy to figure out how many contracts you may want to enter to

achieve your desired result. However, for those strategies that vary on the size of stops or even

the instrument traded, figuring out the amount of contracts to enter can get a little tricky.

One of the easiest ways to make sure you are getting as close to the amount of money that you want

to risk on each trade is to customize your position sizes. A standard lot in a currency trade is

100,000 units of currency, which represents $10/pip on the EUR/USD if you have the U.S. dollar (USD)

as your base currency; a mini lot is 10,000.

If you wanted to risk $15 per pip on a EUR/USD trade, it would be impossible to do so with standard

lots and could force you in to risking either too much or too little on the trade you place, whereas

both mini and micro lots could get you to the desired amount. The same could be said about wanting

to risk $12.50 per pip on a trade; both standard and mini lots fail to achieve the desired result,

whereas micro lots could help you achieve it.

In the realm of trading, having the flexibility to risk what you want, when you want, could be a

determining factor to your success.

- Determine Your Timing

There may not be anything more frustrating in trading than missing a potentially successful trade

simply because you weren’t available when the opportunity arose. With forex being a 24-hour-a-day

market, that problem presents itself quite often, particularly if you trade smaller timeframe

charts. The most logical solution to that problem would be to create or buy an automated trading

robot, but that option isn’t viable for a large segment of traders who are either skeptical of the

technology/source or don’t want to relinquish the controls. That means that you have to be available

to place trades when the opportunities arise, in person, and of full mind and body. Waking up at 3am

to place a trade usually doesn’t qualify unless you’re used to getting only 2-3 hours of sleep.

Therefore, the average person who has a job, kids, soccer practice, a social life, and a lawn that

needs to be mowed needs to be a little more thoughtful about the time they want to commit. Perhaps

4-Hour, 8-Hour, or Daily charts are more amenable to that lifestyle where time may be the most

valuable component to trading happiness.

When the market price moves in a favorable direction (up for long positions, down for short

positions), the trigger price follows the market price by the specified stop distance. If the market

price moves in an unfavorable direction, the trigger price stays stationary and the distance between

this price and the market price becomes smaller. If the market price continues to move in an

unfavorable direction until it reaches the trigger price, an order is triggered to close the trade.

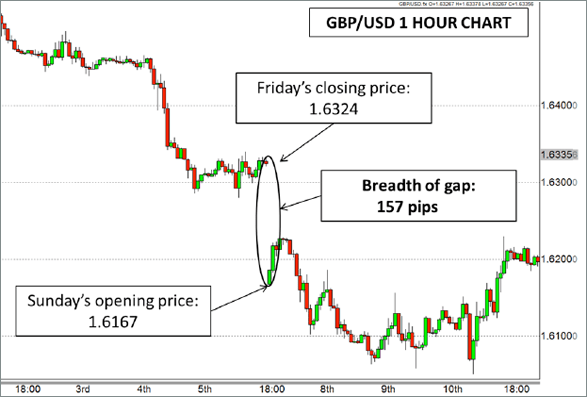

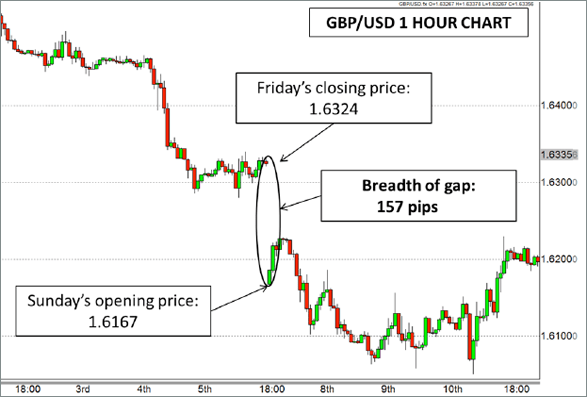

- Avoid Weekend Gaps

Many market participants are knowledgeable of the fact that most popular markets close their doors on

Friday afternoon Eastern Time in the US. Investors pack up their things for the weekend, and charts

around the world freeze as if prices remain at that level until the next time they are able to be

traded. However, that frozen position is a fallacy; it isn’t real. Prices are still moving to and

fro based on the happenings of that particular weekend, and can move drastically from where they

were on Friday until the time they are visible again after the weekend.

This can create “gaps” in the market that can actually run beyond your intended stop loss or profit

target. For the latter, it would be a good thing, for the former – not so much. There is a

possibility you could take a larger loss than you intended because a stop loss is executed at the

best available price after the stop is triggered; which could be much worse than you planned.

While gaps aren’t necessarily common, they do occur, and can catch you off guard. As in the

illustration below, the gaps can be extremely large and could jump right over a stop if it was

placed somewhere within that gap. To avoid them, simply exit your trade before the weekend hits, and

perhaps even look to exploit them by using a gap-trading technique.

- Watch the News

News events can be particularly perilous for traders who are looking to manage their risk as well.

Certain news events like employment, central bank decisions, or inflation reports can create

abnormally large moves in the market that can create gaps like a weekend gap, but much more sudden.

Just as gaps over the weekend can jump over stops or targets, the same could happen in the few

seconds after a major news event. So unless you are specifically looking to take that strategic risk

by placing a trade previous to the news event, trading after those volatile events is often a more

risk-conscious decision.

- Make It Affordable

There is a specific doctrine in trading that is extolled by responsible trading entities, and that

is that you should never invest more than you can afford to lose. The reason that is such a

widespread manifesto is that it makes sense. Trading is risky and difficult, and putting your own

livelihood at risk on the machinations of market dynamics that are varied and difficult to predict

is tantamount to putting all of your savings on either red or black at the roulette table of your

favorite Vegas casino. So don’t gamble away your hard-earned trading account: invest it in a way

that is intelligent and consistent.

So will you be a successful trader if you follow all six of these tenants for managing risk? Of

course not, other factors need to be considered to help you achieve your goals. However, taking a

proactive role in managing your risk can increase your likelihood for long term success.